[ad_1]

The volume of RIA mergers and acquisitions dropped last year after a decade of robust acceleration, DeVoe & Co. notes in a new survey.

This decline occurred even though multiples remained high, while a strong stock market provided a boost to RIAs’ assets under management, revenues and profitability.

DeVoe does not forecast a blockbuster year for M&A in 2024 but does expect momentum to trend upward over the next five years. Key to this increase will be advisors’ lack of succession planning and interest in gaining the benefits of scale.

Eventually, the report said, continued consolidation at the top of the industry will drive an expanding competitive advantage for the biggest outfits. Over time, more advisors may feel competitive pressure to join them, further accelerating M&A.

For the medium to long term, however, DeVoe believes that space exists in the marketplace for RIAs of all sizes. They can all serve clients extremely well — perhaps even better than other business models. The attractive economics and low barriers to entry can create a fertile environment for well-run RIAs of all sizes to maintain success and prosperity.

The annual DeVoe survey is designed to collect advisors’ perspectives about a variety of merger, acquisition, sale and succession topics. The firm conducted its latest survey between July and September among 102 senior executives, principals or owners of RIAs that ranged in size from $100 million to more than $10 billion in assets under management.

The charts below are from the DeVoe report. Click to enlarge.

1. The next-gen succession crisis is here.

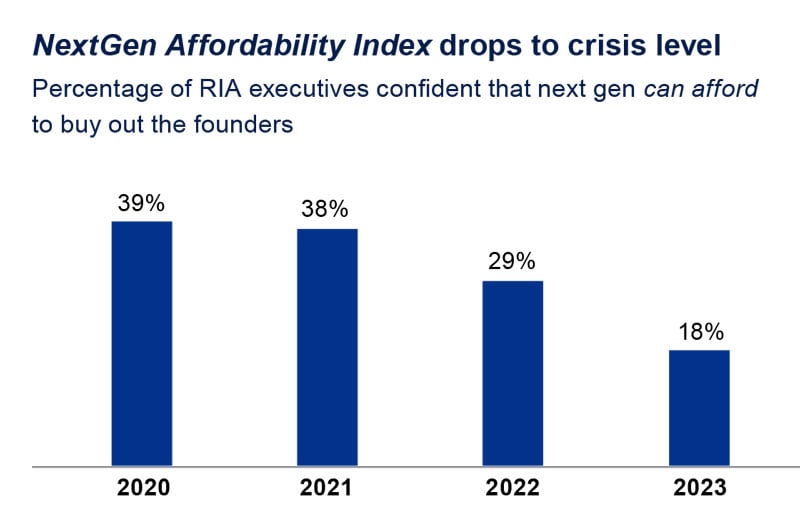

In a fragmented industry with a bias toward internal succession, DeVoe’s NextGen Affordability Index has been dropping quickly.

One reason is the increasing valuations of RIAs, which trended upward from a low in 2008 to sustained all-time highs since 2020. The continuous rise in interest rates has exacerbated the situation, making loans more challenging to secure and the cost to acquire higher.

Add to that founders’ procrastination to develop and implement plans, contributing to an increase in the affordability gap while putting the best employees at retention risk.

The number of RIA leaders who believe that next-gen advisors cannot afford to buy out the founders has shot up, and the share of those who say they don’t know is also increasing.

These trends suggest that the looming succession crisis has arrived, DeVoe reports.

[ad_2]